Do you want to simplify your WooCommerce prices by removing confusing tax labels?

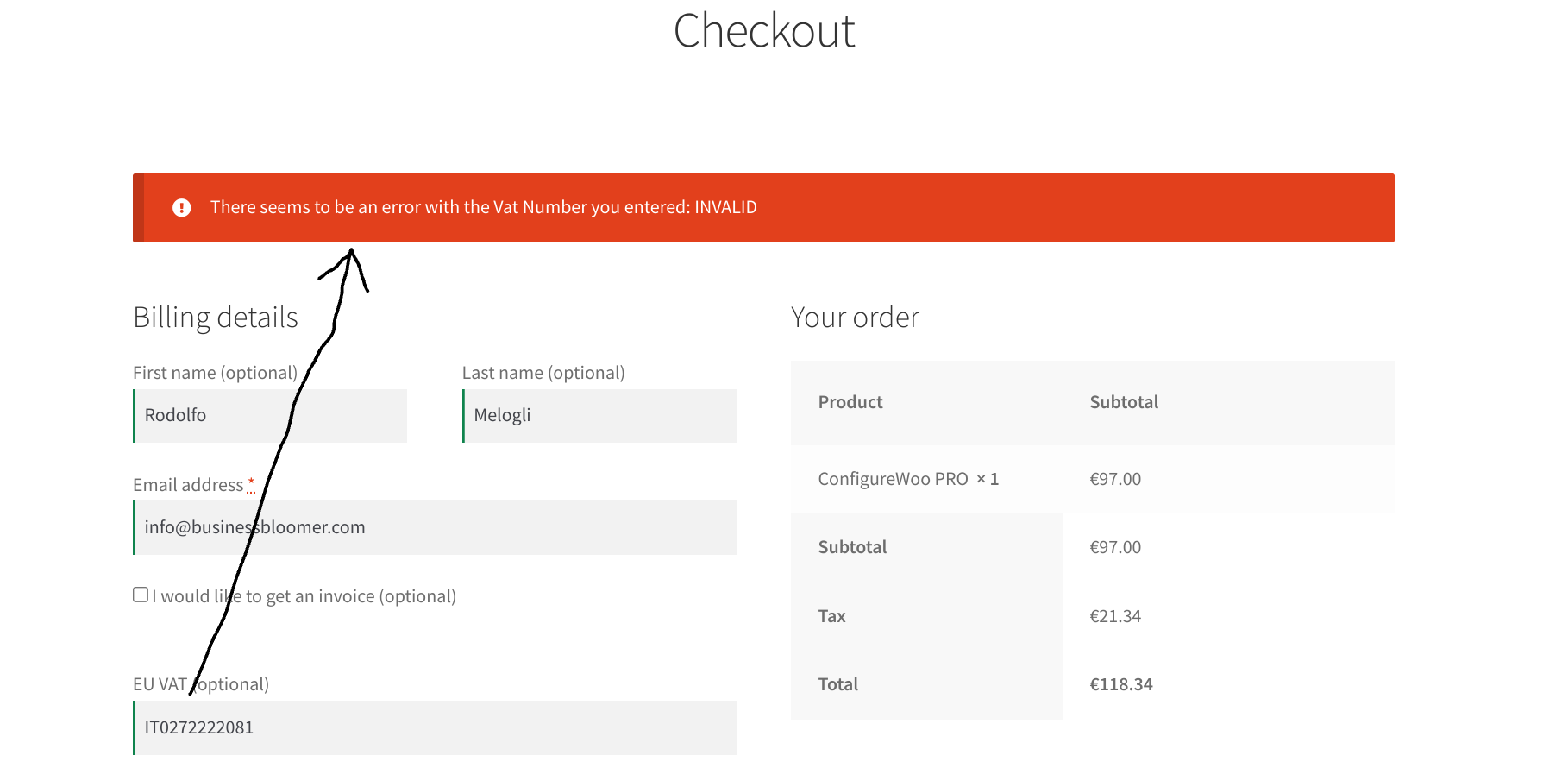

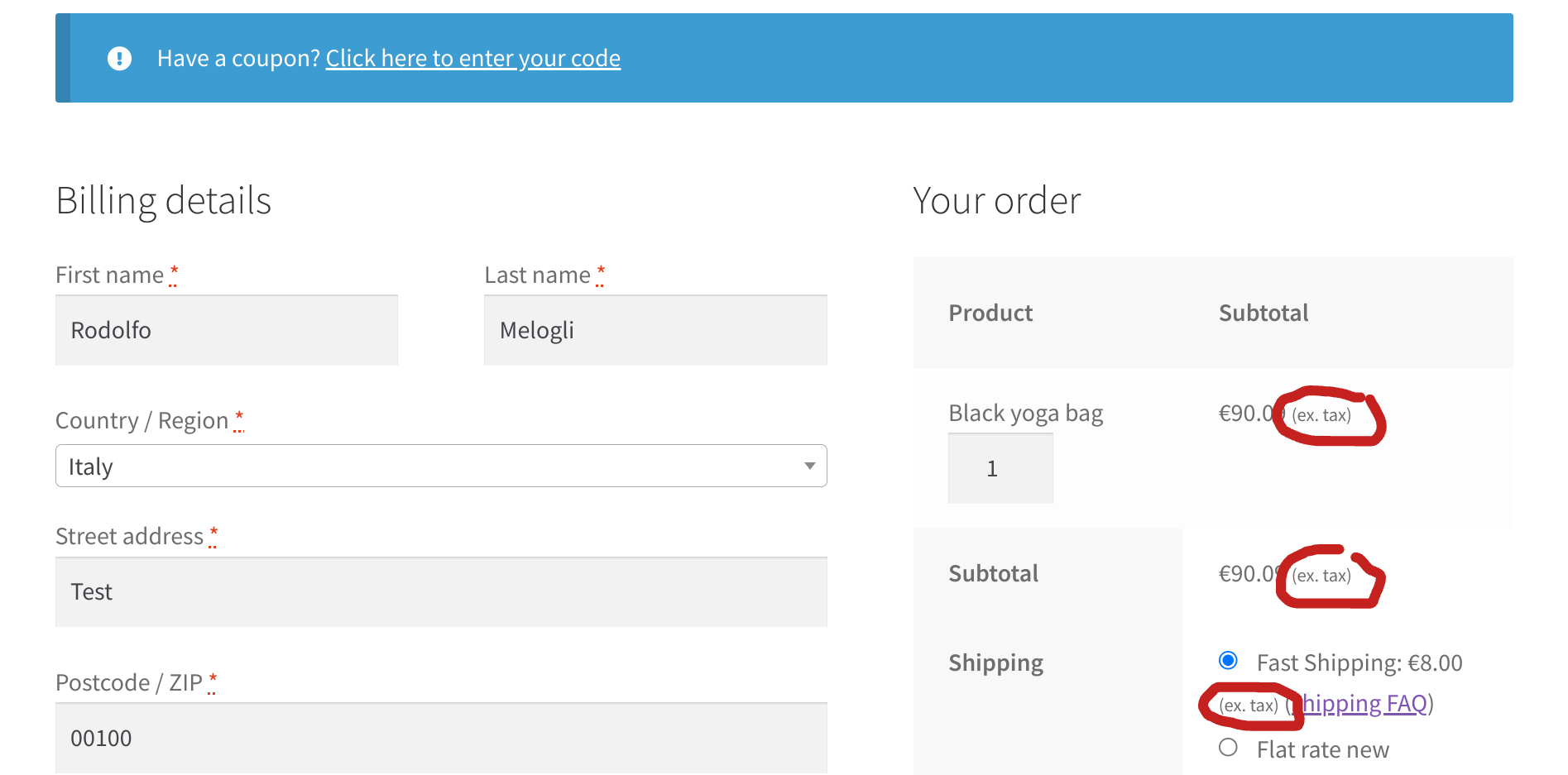

This code tutorial is your guide to removing the “incl. tax” and “ex. tax” labels from your cart, checkout, and order totals in WooCommerce when your “Prices entered with tax” tax option is set to “Yes, I will enter prices inclusive of tax“.

Whether you find them unnecessary or want to create a cleaner pricing display, this tutorial will walk you through two effective snippets to achieve this customization.

Enjoy!

Continue reading WooCommerce: Remove “incl. tax” “ex. tax” Labels From Cart / Checkout / Order Totals